If lower oil prices are straining Saudi Arabia’s economy, it certainly does not show.

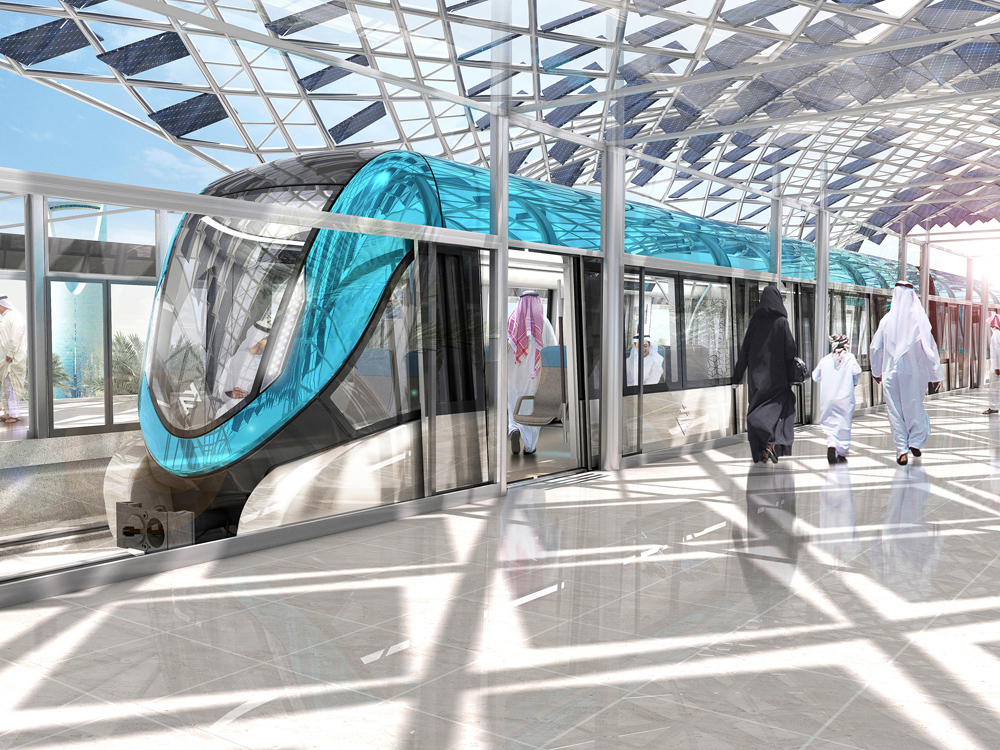

In Riyadh, dozens of cranes loom over the King Abdullah Financial District, destined to be the kingdom’s answer to Canary Wharf in London, with around 60 gleaming towers and its own monorail. Across the city, immigrant workers toil on new residential developments aimed at plugging the country’s acute housing gap.

Meanwhile, roads are being dug up for a new metro system.

It is quite a transformation for a place that started off as a mud-brick stopover on a desert trading route. With its glass-clad skyscrapers, spanking new universities, five-star hotels and outposts of western department stores like Harvey Nichols, Riyadh is transforming itself from a somewhat shabby city into a gleaming symbol of the kingdom’s oil wealth.

But below the prosperous surface, trouble is brewing. Saudi Arabia is trying to digest the dramatic plunge in the price of crude oil since last June. Despite a recent rebound in Brent, the international benchmark, to around $67 a barrel, oil is still down more than 40% since last summer.

So far, the impact on Riyadh’s 5.7 million residents has been muted. “For me it’s business as usual,” says Abdallah Mohammad Al Amri, a social media entrepreneur. “But although we’re not affected right now, lower oil prices are bound to have an impact on the broader economy.”

The only solution, he says, is for Saudi Arabia to diversify away from oil exports, which still account for 43% of its gross domestic product.

The irony is that Saudi Arabia itself played a role in the price decline. Brent was driven downwards by the huge glut created by surging US shale oil production. But it went into freefall last November after Opec, the Saudi-dominated producers’ cartel, decided to keep production steady rather than cut it to prop up prices. Riyadh made clear it was prepared to endure a period of cheap crude rather than forego market share.

But despite that bravado, the price plunge represents a huge fiscal headache for the Saudi royal family. The world’s largest oil exporter, Saudi Arabia is a lot more vulnerable to low oil prices than other producers with more diversified economies: in recent years, oil revenues have accounted for more than 90% of government income.

Moreover, its economic health is predicated on crude prices staying high. Saudi’s break-even — the oil price required to balance the budget in any given year — has been rising fast, from $68 a barrel in 2012 to between $95 and $106 this year, according to a report by Khalid Al Sweilem of the Belfer Centre. With oil now trading far below that level, the budgetary implications for Riyadh are worrying.

Saudi officials insist the kingdom is well-insulated from the oil shock. But it has been burning through its huge buffer of foreign exchange reserves, which peaked at around $800 billion in mid-2014. Reserves dropped by $36 billion in March and April alone. Economists forecast that without a change of course, they could dwindle to $500 billion within two years.

The state’s largesse moved up a gear when Salman Bin Abdul Aziz, the new king, ascended to the throne in January and quickly announced bonus payments for public officials and, later, the military — a major outlay in a country where a third of all jobs are in the public sector.

The six-week military campaign against Yemen’s Al Houthi rebels has also imposed a growing fiscal burden on Riyadh. The result is that Saudi Arabia’s 2015 budget assumes a deficit of $40 billion; it could be even bigger if oil prices stay low.

“People may not be feeling the oil price fall, but they are asking questions about what happens to the country’s budget,” said Aldo Flores-Quiroga, secretary-general of the Riyadh-based International Energy Forum.

Yet the oil drop has not affected Riyadh’s ambitious capital expenditure plans. Ebrahim Al Assaf, Saudi finance minister, acknowledged that the low oil price presented a “challenge for exporting countries”, and the government would have to “rationalise” spending. But he insisted his country’s financial position was “very strong” and it would press on with the almost 2,600 projects valued at $50 billion to which it committed itself last year.

On the other hand, signs of a slowdown are emerging in some quarters. Companies reliant on government contracts are forecasting lower revenues this year, while the oil sector is already feeling the effects. “[State-owned oil company] Saudi Aramco and other government agencies are not greenlighting all projects,” says one western diplomat in the capital. “While headline projects are going ahead, others will be cut or put on hold indefinitely.”

Analysts say these include plans for deepwater drilling in the Red Sea. Meanwhile, dozens of foreign contractors hired by Saudi Aramco to construct a number of sports stadiums across the country are still waiting for their projects to be given the green light.

The slowdown has stoked fears that job opportunities for the kingdom’s growing army of young adults could be restricted. “Students already point out that Aramco had a freeze on hiring for some divisions and [the local branch of international oil services group] Schlumberger has been laying off some of its most recently hired graduates,” said one professor in the kingdom’s eastern province, home to the bulk of the country’s oil industry. “So there is real concern about the negative impact this could have for employment.”

Changes instituted by King Salman are designed to help cope with the challenging new oil price environment. As part of a big shake-up earlier this year, the king appointed his son, Deputy Crown Prince Mohammad Bin Salman Al Saud, as head of the council on economic and development affairs, which has the job of improving co-ordination between the ministries and spearheading economic reforms.

Prince Mohammad, who is only 30, has impressed western officials, who say he appears fully aware of the need to boost the kingdom’s employment rate and diversify its economy away from oil. But he has yet to set out a vision for how to reach that goal.

For the time being, work continues unabated on the King Abdullah Financial District, and most of Riyadh’s other megaprojects.

“When the cranes come down, then we’ll really know that things are bad,” says John Sfakianakis, Riyadh-based director of Ashmore Group. “Until then, for Saudi citizens they haven’t yet felt the pinch.”

Source: Gulf News