Mexican regulators announced that they would continue easing the pace of oil auctions on deepwater and shale production for private investors – in line with the country’s controversial energy reform – due to oil prices slump, The Wall Street Journal reported. Energy officials stated that the process will be slowed in expectations for the oil price market to swing back to more profitable numbers.

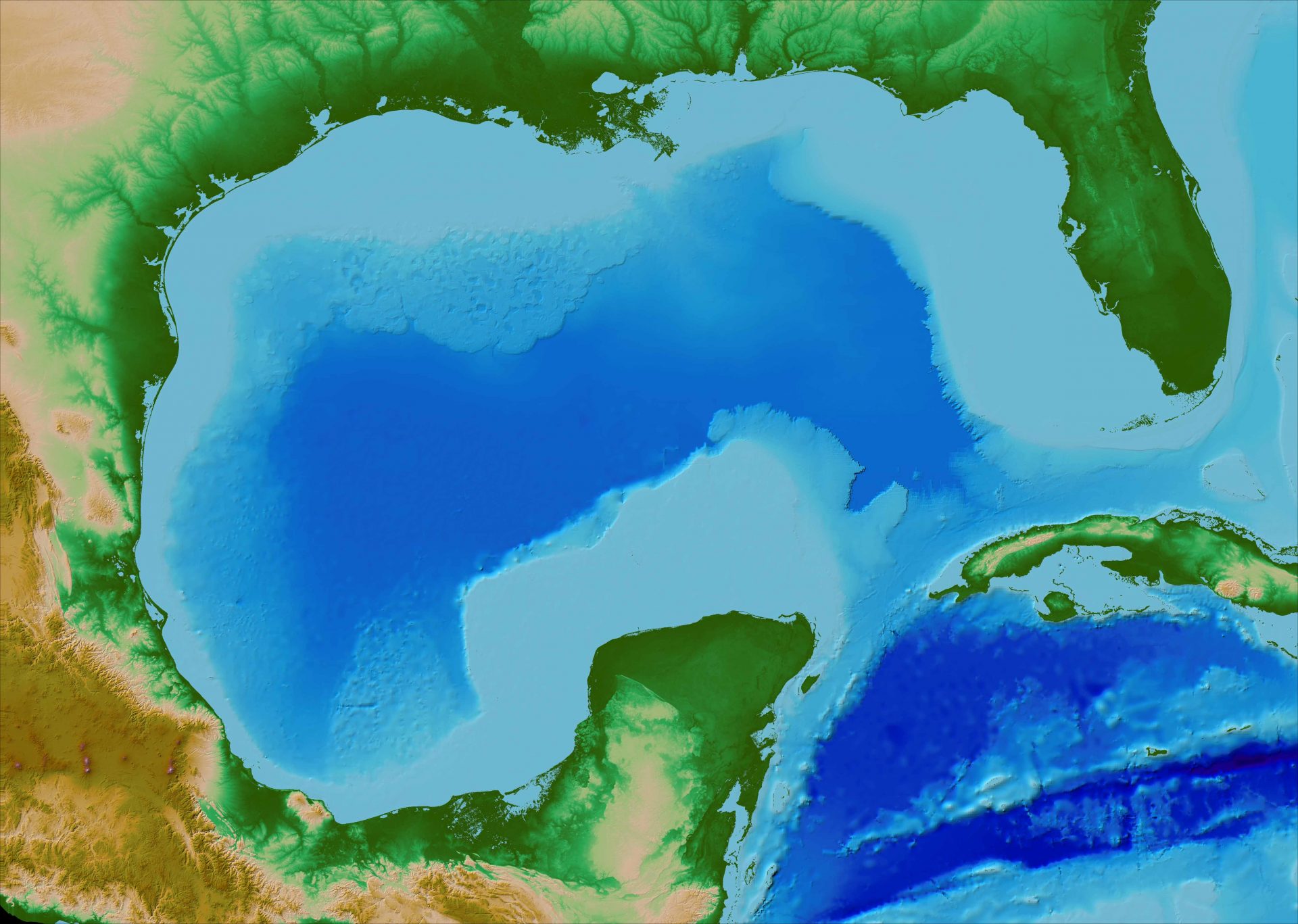

Following the three oil auctions for onshore and offshore blocks in 2015, that were relatively small to garner much interest by state-owned Pemex, the country will halt the fourth auction, originally scheduled for 2016. The auction, which was initially planned to focus on production bids for deepwater areas already discovered in the Gulf of Mexico, will necessarily be switched to merely exploration operations, which will postpone deepwater production by at least a decade, Rigzone explained. The auction date is to be announced by the end of September 2016 based on market assessments, Energy Minister, Pedro Joaquin Coldwell, told The Wall Street Journal.

Deepwater phase of exploration and production will be critical for Mexico’s government to be able to attract foreign investors in order to establish a desired private Mexico exploration and procution (E&P) sector, according to an analysis published by Wood Mackenzie, as cited by Rigzone. But Mexico is to face several challenges in its efforts to launch costly oil and gas blocks in the deep waters of the Gulf of Mexico, where merely 35 exploration wells have been drilled to date. The country will struggle with a lack of deepwater infrastructure, insufficient funds, missing technological know-how, technical complexity of reservoirs, and long lead time on deepwater projects.

The government’s adopted energy reform is designed to end 80-year oil monopoly of the National Oil Company Petróleos Mexicanos, Pemex.