International shareholders in East Mediterranean Gas (EMG), the company that oversaw the now defunct Egyptian-Israeli natural gas deal, said on Thursday they were suing the government of Egypt for violating three bilateral investment treaties.

The decision to take legal action against the Egyptian government under treaties with the United States, Poland and Germany is the strongest move so far by the group, ensuring the dispute is handled diplomatically and not just commercially.

Egyptian state-owned oil and gas companies announced on April 22 the termination of gas sales to Israel, which were part of a 20-year deal, following a year of sabotage and pipeline attacks that had already disrupted supplies.

Israeli and Egyptian officials have tried to play down the ending of the 2005 deal, saying the cancellation of the contract supplying Israel with 40 percent of its gas needs resulted from a business dispute.

However, there have been growing public calls within Egypt to review ties with Israel since the overthrow of President Hosni Mubarak, for whom a peace treaty with Israel was a cornerstone of regional policy.

Thursday’s announcement came after months of unsuccessful attempts to resolve the issue through negotiation, one of the shareholders, Ampal-American Israel Corp, said.

Egypt’s Foreign Ministry could not immediately be reached for comment.

The investors, who include Thai energy giant PTT, U.S. businessman Sam Zell and Israel’s Merhav, are also suing the Egyptian oil and gas companies. Together they are seeking up to $8 billion in damages.

“The investors’ disputes with Egypt arise out of a series of acts and failures by the government of Egypt that have seriously undermined the value of the investors’ investments in EMG,” Ampal said in a statement.

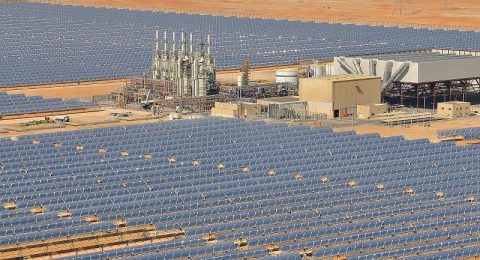

The underwater pipeline, which EMG spent about $500 million on building, had been targeted by militants in Egypt’s unruly Sinai peninsula numerous times, halting the flow of gas for most of the past year.

In 2010, prior to the attacks, EMG provided 2.5 billion cubic meters (BCM) of gas to Israeli customers. But that number was expected to more than double throughout the 20-year deal.

Israel’s energy sector will likely be hurt in the short term, but the country has been weaning itself off the once-crucial supplies and has a number of contingency plans that will lessen the impact.

U.S.-based Ampal said it had submitted a request for arbitration to the World Bank’s International Center for Settlement of Investment Disputes in accordance with the Egyptian-U.S. bilateral treaty.

Ampal’s chairman, Israeli magnate Yossi Maiman, is also a Polish national, and a German citizen is invested in EMG as well, allowing the group to seek compensation under the Polish and German treaties, the statement said.

Source: Reuters