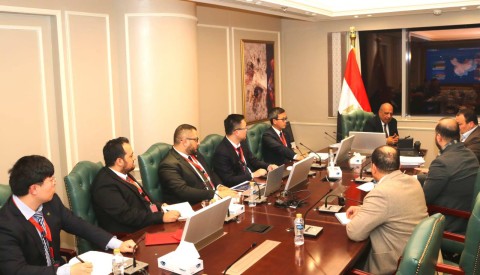

Egypt’s ministry of electricity and renewable energy and the Middle East Solar Industry Association (Mesia) sponsored a two-day roadshow in Cairo, which kicked off yesterday, to bring together international investors.

Mohamed El Sobki, chairman of Egypt’s New & Renewable Energy Authority (NREA), stated at the event Tuesday that the country was targeting 18,000 megawatts of renewable energy projects — mainly wind and solar — over the next five years, which would require an investment of more than $20bn. He added that Egypt aims to achieve financial closure on up to 500MW of solar energy projects by next summer. A feat industry insiders are quickly finding to be herculean.

Officials at the event were unable to allay investor concerns over the convertibility of the Egyptian pound, a key factor in assessing risk, amid scarcity of available US dollars. Billions of dollars in renewable energy funding is waiting to flow into Egypt, yet currency risks are stalling investment.

“Currency and convertibility is arguably the number one issue at the moment,” said Marc Norman, Dubai associate at the New York-based law firm Chadbourne & Parke, which is advising companies looking at Egypt’s power sector.

The tariff mentioned for large-scale projects has been set in US dollars but will be paid in Egyptian pounds. The government will guarantee conversion of 15 per cent of any amount paid at a fixed rate of 7.15 pounds to the dollar. The remaining 85 per cent would need to be converted at the prevailing market rate.

“All of these companies want to invest millions and millions of dollars, yet the regulatory framework and currency issues are clouds over the renewable energy sector,” according to Vahid Fotuhi, the president and founder of Mesia. He estimated that at least $750 million in renewable energy investment was ready to be funneled into Egypt over the next two years, but currency risks were shadowing investor appetite.

Source: The National