Alcazar Energy Partners II SLP (SCSp) (“AEP-II”) a Luxembourg domiciled sustainable infrastructure fund focused on utility-scale renewable energy

projects in emerging markets, has achieved a first close of US$336.6m.

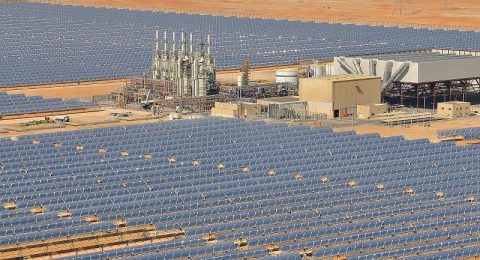

This landmark transaction will enable the development and construction of over 2GW of clean energy infrastructure across selected emerging markets. AEP-II aims to achieve a total generation equivalent to powering over one million households and saving c.a. 3.2m tonnes of Greenhouse Gas emissions.

Alcazar Energy Partners II SLP (SCSp) said that it has signed the first memorandum of understanding (MoU) with the Egyptian government to invest in green hydrogen-based ammonia.

AEP-II added that the facility aims to produce 230,000 tons/year powered by a dedicated 1GW renewable energy plant. This transaction encouraged a number of European and Asian investment grade off-takers to provide an off-take agreement for the project.

The company stated that it aims to contribute $650 million in mid-market renewable energy investments in addition to allocating $2 billion in foreign direct investments (FDI) in mature markets.

On this occasion, Daniel Calderon, Co-Founder and Managing Partner of Alcazar Energy, commented: “The successful first close of AEP-II is a tribute to the disciplined and responsible work of our Alcazar team, who originated, developed, and exited AEP-I’s portfolios, creating value for investors and, most importantly, for the countries and communities where AEP-I invested.

“AEP-II is privileged to have the confidence of an outstanding group of public and private institutions to invest and develop in renewable energy projects, mobilising more than $2bn of foreign direct investment from OECD economies to build sustainable infrastructure where it is needed most.”

Alcazar Energy Partners (“AEP-I”) dedicated $240 million of equity and mobilized total FDI in excess of $700 million into seven solar and wind farms in Egypt and Jordan, which created over 4,200 construction jobs and generated electricity able to power over 350,000 households.