ADES Holding Company has announced its plans to float 30% of its share capital on the Saudi Tadawul. The company’s IPO offers 338,718,754 ordinary shares, which will be listed and traded on the Saudi Exchange’s Main Market following the completion of the IPO and listing formalities with the CMA and the Saudi Exchange.

The final offering price will be determined at the end of the book-building process.

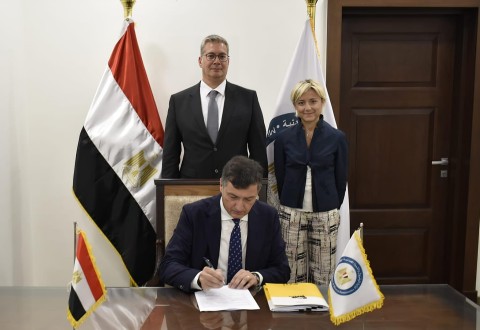

“ADES’ IPO on the Saudi Exchange marks an important milestone for the Company and is a key step in realizing our ambitious growth strategy. Our extensive track record of operational excellence and successful growth, underpinned by our high-quality client relationships, resilient business model and solid backlog, means we are well positioned to deliver strong returns to shareholders. Our IPO offers international and retail investors a highly compelling opportunity to invest in a leading global drilling operator with a growing international footprint,” Mohamed Farouk, CEO of ADES, commented.

“We are now present in the most attractive drilling markets globally and partner of choice for the largest and most reliable energy suppliers around the world. Our IPO will support us in continuing to deliver growth and cement our position as the leader in the jackup drilling market in Saudi Arabia and globally,” Ayman Abbas, Chairman of ADES, noted.