By Emad El Din Aysha

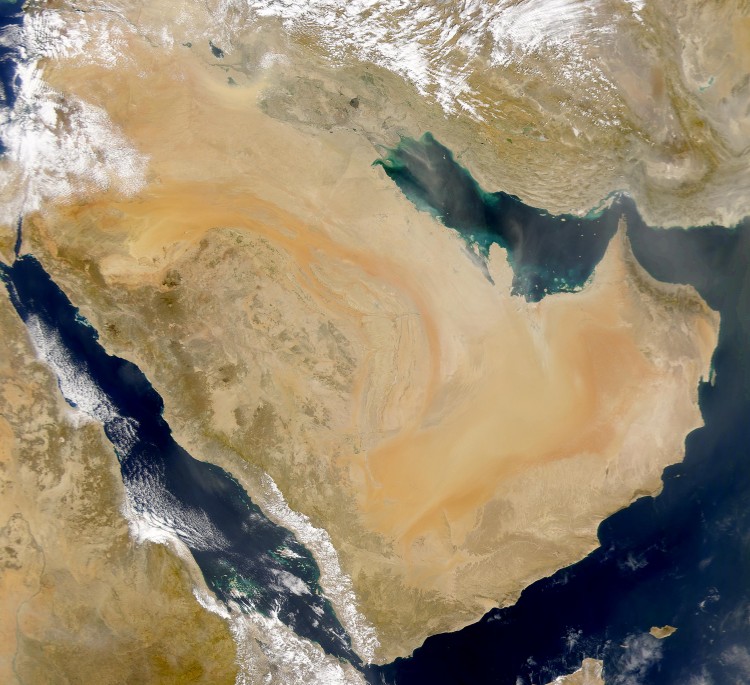

Joseph A. Kéchichian, Senior Fellow at the King Faisal Center for Research and Islamic Studies, gave a timely lecture entitled “The Enduring Arab Gulf States: A Medium Term Perspective” at the American University in Cairo.

The initial focus of his talk was Christopher Davidson’s After the Sheikhs: The Coming Collapse of the Gulf Monarchies, predicting the ultimate demise of these royal families as he did in his previous book, published before the Arab Spring. Davidson explained how these monarchies weathered this latest storm, just as they have withstood Arab nationalism, socialism, and republican coups. A flaw in Davidson’s interpretation of the scene, can be viewed through his insistence that oil and religion explain how the gulf monarchies accomplished this feat, a set of answers that betrays a profound ignorance of the paradoxical nature of oil economics and the dynamic nature of stability in the region.

Prop-ups and Backlogs

Gulf States are “distributors of wealth” as opposed to the more common “extractors” of wealth, says Kéchichian, and not just at home. They share their wealth with their less well-endowed neighbors, such as Oman and Bahrain and often use the GCC as a miniature version of NATO to settle disputes and put out regional fires, as seen in Yemen and previously in Bahrain.

What is not readily recognized is how unusual this is in the Arab setting. Even oil-rich countries like Iraq and Libya—under their original dictatorships—did not develop poorer regions through oil and gas projects. They insisted on keeping all the wealth in the center out of fear that such far-flung provinces would become pockets of resistance, to cite speakers at the Fourth Annual Conference of Arab Association of Constitutional Law, held last May.

Even researchers specializing in the Arab Spring have come to admit that the “size of the ruling coalition in rentier states is not determined by oil wealth per se, but by the countries’ experiences in dealing with societal contestation before oil started to influence the reorganization of state institutions,” says Andreas Kaufmann of the International Relations and Security Network (ISN).

Rentierism here references how oil revenues are used to placate the masses—free education, subsidies, guaranteed employment, public services, tax breaks, etc. However, as Kéchichian says, critics forget that local opposition groups are angry about this fact itself, arguing that too much money is spent on security and publicity stunts. The recent fracas surrounding FIFA, notwithstanding Qatar’s 2020 World Cup ambitions, actually makes perfect sense from an economic perspective, says James Dorsey, senior fellow at the S. Rajaratnam School of International Studies at Singapore’s Nanyang Technological University.

After the Iraqi invasion of Kuwait Qataris concluded that they could never protect themselves no matter how much they spent on defense, leading to the large American airbase now located in the country. The money that originally went to US military contractors now goes to such diplomatic gestures, reveals Dorsey. Such soft power moves actually bear tangible results and are eagerly greeted and lobbied for in the West.

In fact, oil can actually slow the path towards industrialization. This is known as the dreaded “Dutch Disease,” since strong currencies propped up by hydrocarbons choke off non-oil exports, while investments flow invariably to the guaranteed, easy profits proven by oil. This was a problem Holland suffered in the 1980s, thanks to the North Sea oil bonanza, a country that was already developed and democratic. Oil, like everything, is a double-edged sword. The benefits depend how the resource is used; if you are not cautious, it will use you.

Regarding religion, religious reform has actually been on hold in the Gulf States thanks to the Islamist resurgence (1980s-90s) brought on by the Iranian revolution. In Saudi Arabia specifically it was Juhyman Al-Utaybi’s takeover of the Holy Mosque in Mecca in November 1979 that cajoled the regime into a delicate balancing act with hardliners in the country, veering off its original modernization path.

Parting of Paths

Admittedly Kéchichian is not an economist himself, as he confessed during the lecture, but he downplayed the threat posed by the so-called shale revolution in America. Fracking was no doubt helping the United States at the moment, reducing the country’s dependency on imported oil, but shale oil is still a non-renewable fossil fuel. This is the biggest threat of all facing the Gulf states.

The oil will eventually run out, possibly lasting for another 100 to 150 years, and in the meantime an alternative fuel may be discovered. The good thing about oil though is that it gave you the ability to plan for the future. What worries Kéchichian are the unanswered questions: Who will preside over this energy transformation? Which future political elites will be drawn from younger generations? The choice facing the regimes in Kéchichian’s opinion was clear: either reform or chaos on the Islamic fundamentalist models of Iraq with ISIS or Egypt with the Muslim Brotherhood.

The choice facing the regimes in Kéchichian’s opinion was clear: either reform or chaos on the Islamic fundamentalist models of Iraq with ISIS or Egypt with the Muslim Brotherhood. He advises that Gulf States take up some modicum of parliamentary life, constitutionalism, and the rule of law, in line with the Saudi restructuring of the judiciary in 2007 to get clerics out of legal matters.

For what it is worth Kéchichian may actually be right. If you look at statements of prominent Saudi figures they insist that oil will never, ever return to $100 a barrel. This looks like a rash judgment but perhaps they know something we do not. Bahrain has been publicizing moves to redirect energy subsidies to ensure the genuinely needy get them, while pushing up the price of various domestic fuels. The UAE is rewriting its corporate and investment laws, even to the point of allowing total foreign ownership, supposedly in an effort to make itself more globally competitive. Gulf states are opening themselves up to foreign direct investment in infrastructure projects, traditionally a no-go area, with an uncharacteristic crackdown on corruption in the region and specifically in the petroleum sector.

It could be they are buckling under the unexpected decline in oil prices, or it could be they had backup plans in store all along and are taking advantage of the lull in prices to push through unpopular policies. The GCC is now seriously contemplating the long taboo policy of a Value Added Tax (VAT), and calling on the IMF for advice to help them carry this out. Saudi Arabia is introducing a land tax too and has been following the path of the smaller Gulf states in encouraging tech startups and SMEs (small and medium sized enterprises) to soak up cascading youth unemployment.

Everyone in the Gulf is now heavily investing in research and innovation; with a particular focus on petrochemicals, petroleum coke, and plastics. They are also focusing on oil recovery techniques, renewable energy—both in terms of exporting technologies and attracting foreign investments into green energy—industrial free trade zones, and most recently, nuclear power (first in the UAE and now Saudi Arabia and with Russian help to boot).Where are they getting the money for all this?

Apart from clever moves like getting foreign competitors to bid against each other over concession contracts—look at French Total in the UAE—it is safe to assume that Gulf States saved up enough during the oil price binge from 2003 to 2014. This was also the period that gave birth to the rival shale industry. Could Arab and American energy interests be drifting apart?

The historical Fault-lines Ahead

The US certainly wants to disentangle itself from the Middle East’s internal political antagonisms. Note, as Kéchichian does, that Saudi policy diverges with American interests in Yemen. When asked about the Obama Administration, Kéchichian said that given its long history of foreign policy failures, it could be that the US is sponsoring Iran’s growing empire in the hope of getting a deal out of Tehran to give up on its atomic bomb ambitions, at least until his presidency comes to a close. After that, it is the next president’s problem.

It could also be argued that the Gulf States are worried about the economic consequences of Iran coming back online, with all that stored up oil (in tankers) that could further depress prices if and when sanctions are lifted. To their credit, Iran is planning for a post-oil future itself, with the economy minister Ali Tayyeb-Nia warning of a “Dutch Disease” that could wipe away all the progress recently made in manufacturing. With Jordan signing its own nuclear power deal with Russia—shortly after Egypt—a peaceful applications race is already in the offing, and as Kéchichian puts it, Iran’s scientists and engineers are not about to conveniently forget all their nuclear knowledge. Kéchichian is not worried about Yemen either. His real worries are in places up north, such as Iraq. ISIS is the sworn enemy of the Gulf monarchies and he believes Iraq will end up dividing apart, with Syria and Lebanon soon to follow.

Tribal solidarity has kept the Gulf Arabs together so far but there is nothing like nationalism to keep one united beyond religious differences, at least according to the Egyptian and historical European model, explained Kéchichian. He has seen this firsthand living in Lebanon, a country that still does not have a president thanks to Hezbollah. The real key to the resilience of Arab monarchies is both how flexible and how “open” they are. Non-oil wealthy Jordan and Morocco weathered the Arab Spring because their kings made reforms early on.

Arab tribal tradition also mandates that every tribesman have access to his sheikh, almost as a birthright. This may be beneath our democratic aspirations, done as it is in a very top-down, paternalistic fashion, nonetheless it is a tradition that has persisted since the earliest days of Arab royalty—from the Umayyad dynasty onwards. The trick is to balance tribal openness with nationalistic fervor, something that must be done skillfully in order to avoid the same destiny as that of the Umayyads.