News / International

Zuetina Evacuates Employees from OilFields

The Media Office of Zuetina Oil Company has reported that the company has vacated all its employees from oilfield No. 74.

US Hedge Funds Quacking Under Strained Oil, Gas Markets

Hedge funds cut bets on rising oil prices at the fastest pace since December 2012 as U.S. inventories expanded to the highest in more than three decades.

Exxon Turns to U.S. Shale Fields to Lead International Growth

In a world of $55 a barrel oil, Exxon Mobil Corp. is relying on shale fields in Texas, Oklahoma and North Dakota to help fund the next wave of big overseas projects it needs to thrive in the future.

Attacks Make Oil Fields NonOperational in Libya

The Libyan national oil company declared 11 oil fields nonoperational because of “theft, looting, sabotage and destruction” by “unidentified armed groups,” the company said in a statement late Wednesday.

Oil Prices Strain Gulf Arab Budgets, Retard Growth

Experts say a majority of key oil exporting Arab countries could face a budget deficit of at least $122 billion in 2015 as the result of the falling oil prices.

Iraq Selling Crude to Asia Below Middle East Benchmark

Iraq narrowed the discount for April crude deliveries to Asian buyers by the most since November 2011, joining other Middle East producers in raising official selling prices amid signs demand is improving.

Kuwait: Shale Oil Decline Ups Prices, Near Future Still Uncertain

A drop in shale oil production has triggered a rebound of global oil prices, but prices will not rise sharply as long as the world's economy stays sluggish, Kuwaiti Oil Minister Ali Al-Omair was quoted as saying

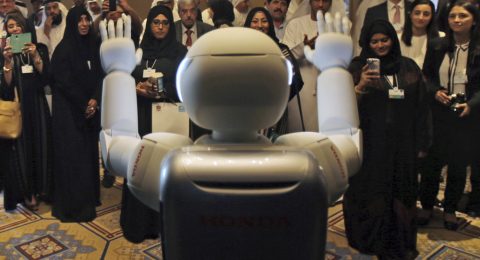

Oil Prices Shift Gulf Arab States to Tech Start-Ups

The U.A.E.’s leadership declared 2015 the “year of innovation,” reflecting aspirations of the Gulf Arab nations to diversify away from oil.