Iran’s Ministry of Petroleum stated that the country’s oil industry is in need of $200b in investments in the upstream and downstream sectors as the domestic fund are insufficient, Oil&Gas Euroasia reported. According to Sputnik International, the upstream sector requires $130b, while $70b is to be earmarked for processing facilities, petrochemical and construction of new refineries in order to help boost Iran’s economy in the period between 2016 and 2020.

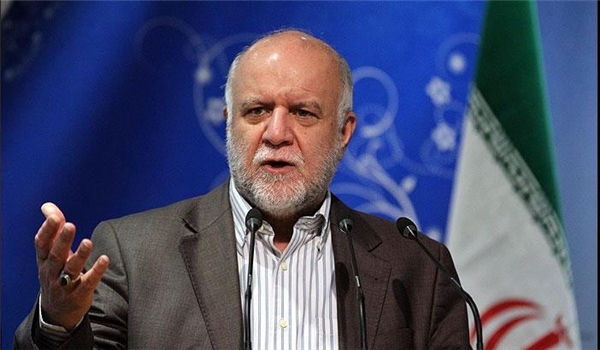

Iran’s Minister of Petroleum, Bijan Zangeneh, expressed his concern in regard to lacking financial resources. Tehran is thus seeking to expand inflow of foreign investments. It is concluding new Iran Petroleum Contracts (IPC) with international oil companies, a contract model meant to attract investments into the country by awarding more favorable terms to the companies. The minister added that the new oil contract models were devised with the objective of materializing development of joint oil and gas fields and enhancement of recovery from oil reservoirs.

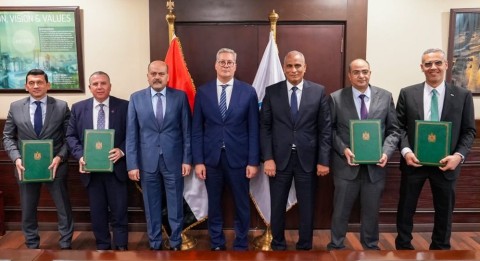

After the removal of Iran’s economic sanctions, multinational companies such as Shell and Total held talks with Iran’s National Iranian Oil Company (NIOC) and the National Iranian Tanker Company (NITC) seeking to upgrade the country’s oil sector. In addition, under the post-sanction condition, Iran is set to receive between $55b to over $100b in its unfrozen assets, NPR informed.