By: Amira S. Badawey

Water is an important element in oil and gas production, both as a bi-product and a commonly used fluid to enhance well production. Water also plays a major role in unconventional oils, namely in the fracking process. As a result, the oil and gas industry simultaneously consumes and produces large amounts of water during the extraction stage.

There are several focuses in water management for the oil and gas industry, such as water utilized in drilling, fracturing, and completion. This covers services required to treat, recycle, transport, and dispose of the resulting effluent, which include frack flowback. According to the Oil&Gas Financial Journal (OGFJ), Halliburton indicated in 2014 that on average 100,000 barrels of water is required for a “typical frac job”, with frack flowback representing about 15% to 40% of this total. The article further explained that 65% to 80% of total oilfield water management expenditures are directed towards water supply, regulations, and transportation.

However, water as a natural resource is becoming ever more scarce. This has led many governments to implement strict guidelines on water treatments and disposal for upstream projects. Moreover, community concern is growing on the environmental impacts of water usage in the industry. As a result, oil companies allocate significant portions of their budget towards water management facilities and rely on water treatment specialists, both to come up with more efficient methods to treat water and mitigate environmental risks.

The main drive behind oil expenditure in water management is to minimize total water lifecycle costs in oilfields. One might perceive a dichotomy in spending money to minimize costs, however, risks associated with ill managed water treatments and uncontrolled consumption at upstream projects outweigh current water management budgets. Nevertheless oil firms strive to find a right balance between the cost and benefits of water management.

Oil and Gas Water Management Needs

A 2015 report titled ‘Oil and Gas Industry Guidance on Voluntary Sustainability Reporting’, which was issued by the global oil and gas industry association for environmental and social issues (IPIECA), Energy API and the International Association of Oil & Gas Producers, indicated that global figures show the industry’s freshwater consumption “is much less than in other sectors such as agriculture, municipal water supply and thermoelectric power generation.” Nevertheless, oil production and water go hand-in-hand as upstream projects process water to injection wells and help recover crude oil and gas. Moreover, SUEZ eMAG stated that in every barrel of oil produced, between 3 and 10 barrels of water that was already present in the wells are recovered. Oil companies must treat the extracted water before recycling and re-injecting it, even if simply to comply with progressively strict discharge standards.

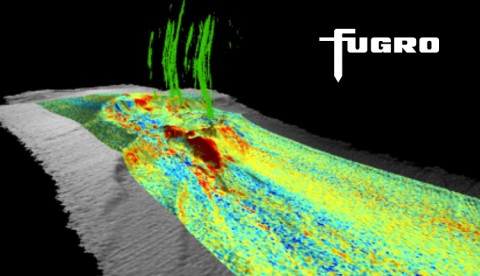

The increasing volumes of water produced during the lifetime of oil wells has created a need for constant water attention and treatment, even more as regulatory scrutiny tightens on oil and gas extraction. OGFJ informed that, “Outside North America, oil wells are producing in excess of 200 million barrels of water per day.” Consequently, oil companies require improved fluids and water management for huge volumes of produced water. Moreover, these huge and steadily increasing volumes of water are in contact with hydrocarbons across various geological formations and will likely be contaminated with “organic constituents such as grease, oil, benzene.” Accordingly, the produced water must be treated before disposal.

Anadarko, an independent oil and natural gas exploration and production company that is based in Texas, stated that during the drilling process, oil firms typically access hydrocarbon resources at depths more than 6000 feet below ground level, while groundwater aquifers are generally located several hundred feet below the earth’s surface, with thousands feet of solid and impermeable rock separating both natural resources. Nevertheless, Anadarko emphasis that well integrity is paramount in protecting groundwater. As a result, various governments have imposed strict regulations and industry standards on the environmental impacts of the drilling process. According to the company’s US onshore operations, Anadarko uses multiple protective layers of steel pipe and cement to seal off the deepest known aquifer. These redundant protective boundaries are put in place to establish wellbore integrity. Additionally, across the production phase, oil companies continually collect and analysis water samples to ensure compliance with environmental standards. These measures all added, to impact operating costs at drilling and extraction sites.

Lost Opportunity Costs

Oil and gas companies make frequent decisions on the use of finite resources, with investments in water stewardship, while integrating water resource management and risk assessment throughout their operations. Companies divert funds to water management efforts to avoid the potential losses due to lagged water management strategies or prosecution due to harmful environmental practices. Moreover, the importance of water related risks for the industry has driven companies and other stakeholders to focus on water technology development, improved water management, utilization of alternative water sources, and the development of collective solutions. Additionally, the link between energy and water is gaining significance as countries look to increase the diversity of energy supplies, including biofuels, which may require greater access to sources of water. As a potentially significant local user and producer of water, the oil and gas industry is vulnerable to water disruption in its operations and value chains. Therefore, investment in sound water management strategies is fundamental to sustain oil production.

As a result, oil and gas firms have incorporated sustainability reporting in their annual reports as a means to engage with stakeholders and help foster informed dialogue about the industry’s environmental impacts and efforts. IPIECA’s ‘Oil and Gas Industry Guidance on Voluntary Sustainability Reporting’ study explained that oil companies assess the impact of local water scarcity on facilities and projects located in certain geographical location. The report added that it is important for these companies to add “narrative” to their annual reports to describe their overall approach to water management and demonstrate responsible “stewardship approached to managing water demands and discharges in relevant operational locations, especially in places where water stress is recognized.” Case in point, Anadarko takes numerous precautions to conserve and protect water by conducting “rigorous assessment” in order to determine suitable water storage solution. The company’s facility in Pennsylvania uses pipelines to transport freshwater to the site. This strategy helped Anadarko reduce truck traffic and associated emissions, while minimizing earth disturbance and conserving available water resources. According to the company’s website, under the Water Management section, “A closed-loop system moves water from a pre-determined and approved source through pipelines to containment facilities for use in the hydraulic fracturing process. Anadarko has employed the use of temporary earthen impoundments and portable, above-ground holding ponds (PortaDams) to store water required for completion operations. The flow-back water from operations is collected in steel tanks and trucked to the next completion site. Here, the produced water is filtered and recycled using newly developed technologies. Additionally, we collect drill cuttings, or pieces of earth that return to the surface during drilling operations, in steel containers until they can be properly tested and disposed of in accordance with regulations.”

Moreover, oil and gas companies employ water treatment activities to mitigate concerns of water aqua resources associated with the fracking process. In general the simplest methodology to dispose of frack flow-back and produced water is to pump volumes down into subsurface zones that are suitable for this kind of disposal, according to OGFJ. Yet these bi-products of the fracking process are becoming too valuable to waste. Therefore, organizations focus on water treatment and recycling methods to enable water volumes applicable for multiple purposes. Yet, oil companies must reflect on the tradeoff between investing in water treatment facilities and the benefit of recycling water resources, while accommodating environmental concerns.

Water Management Economics

A report published by Oilfield Review, titled ‘Water Control’ estimated that more than $40 billion is spent dealing with unwanted water in the oil industry. Moreover, each horizontal well in North America that uses hydraulic fracturing uses 2-6 million gallons of sweet fresh water. As a result multi-billion dollar Water Services industry is emerging in the oil and gas community, as exploration and production (E&P) companies turn to outsourcing their water management needs to focus on reducing operational costs.

Shale Play Water Management states that upfront investments for saltwater disposal (SWD) include the acquisition of land, drilling wells, the construction of buildings, tanks and sometimes ponds. Companies must also invest in equipment for unloading, treating and injecting the water. These capital expenditures (CAPEX) can range from $2 million to upward of $7 million. For successful multi-rig operations, the number of water treatment assists must also be multiply by the number of SWD wells needed to efficiently service the field. Once drilling and production commence, companies incur further operating expenditure (OPEX). These amounts vary depending on “proximity of water-disposal facilities to producing wells, volumes of wastewater production, the means of transportation and the supply-demand situation for water-operating assets in each region.” According to Shale Play Water Management magazine, 60% to 80% of disposal costs are water-hauling expense, which can differ from location to location. Additionally, oil firms that in-house their own water-disposal services incur added CAPEX for trucks.

As the industry adjusts to new commodity prices, with Brent reaching about $53 per barrel at the time of the article, oil and gas operators can no longer ignore operating inefficiencies. E&P firms struggle to economize operations and sustain production, as tradeoff decisions are made daily to balance their returns. For many organizations, revisiting water management strategies makes sense from both an operating and a balance-sheet perspective despite oil-and-gas prices. Respectively, Water Management service providers have been growing in popularity since the early 2010s, according to Shale Play Water Management, as oil firms enhance their performance and returns on investments by categorizing water management as a separate activity within the E&P process, while turning to service providers as needed during oilfield life cycle. Moreover, service provides offer further savings by spreading the fixed costs of water handling over many customers. This is an appealing option for small E&P operators who have limited capital to expend on the production process.

Water is the most commonly used fluid in the oil and gas business, making its usage and management critical to the petroleum industry. More than ever, water is an integral part of the success of oil and gas operations. Without adequate supplies of water, there is no multistage hydraulic fracturing, and without fracturing, there are no oil or gas resource plays. And of course, without resource plays, the trend lines on domestic oil and natural gas supplies would look very different. Therefore, it is in the interest of oil companies to implement sound business practices in handling unwanted water and managing water facilities related to upstream projects. If oil companies can reach a win/win situation in terms of efficient and sustainable operations that don’t negatively impact the surrounding environment, they can augment their bottom-line.

As more oil companies move towards shale production, the topic of water management in the oil and gas industry is becoming even more prevalent. With traditional water souring constricting and wastewater treatment regulations tightening, the oil and gas global communities, together with local environment watch groups, should strive to develop appropriate infrastructure networks needed to deal with water related issues. This is crucial for oil and gas producer to effectively manage well operations while maximizing profits. Moreover, the involvement of governments in water disposal can prove beneficial for indigenous societies, as centralized water management allows wastewater processing to be implemented on an economy of scale, while ensure compliance with environmental regulations. Thus, establishing an advantage for oil and gas firms in terms of lowering operating costs and benefiting local communities under the scope of a sustaining supply of fuel and lessening contaminated environments.