By Nataša Kubíková

The Egyptian Gas Association (EGA) held an executive roundtable – The Future of Natural Gas Industry in Egypt – with the presence of Minister of Petroleum and Natural Resources, Tarek El Molla, on 23rd February, 2016.

Gas industry leaders and top delegates of major gas companies in Egypt shook hands at the Four Seasons Hotel in Cairo, with high expectations for future collaboration on issues affecting the natural gas industry in the country. The event addressed Egypt’s aspiration for the role of a regional gas industry hub and focused on the most burning questions that affect Egyptian government’s policy in line with the processes of liberalization of the natural gas market, reforms and strategy that would attract future foreign investments in the sector.

In the opening remarks, EGA Chairman and Board Member, Engineer Khaled Abu Bakr, defined the main objective of the event which was to address the ways in which the business community together with the Egyptian government could work together on the reform to bring more value added to the industry.

Gas Flaring

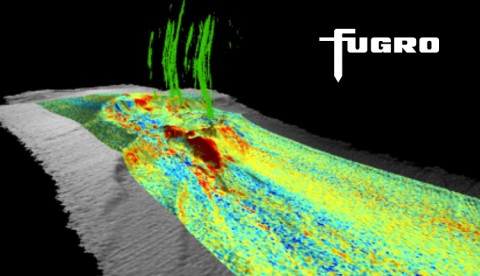

The presentations started with the European Bank for Reconstruction and Development (EBRD) that introduced its findings of a recent study on gas flaring, conducted in close cooperation with EGAS, EGPC, GANOPE and Oil Ministry. EBRD’s Senior Banker for Natural Resources, Gabriel de Lastours explained: “The objective of the study has been to estimate the amount of flaring from the oil fields in Egypt and to propose a viable solution to recover the gas.”

The amount of associated petroleum gas flared from oil fields in Egypt every year reaches the level of 1.7bcm, based on the 2012 statistics. Senior Banker added that “it is important to highlight that Egypt has high flare intensity as compared to its oil production, for example higher than in Saudi Arabia.” The Western Desert has higher flaring intensity, comprising about 50% of country’s overall production, but represents about 60% of the flaring. “One third of the flaring in the country is done by seven large fields, which produce more than 5mcf/d of gas, but more importantly there are about 66 fields that produce less than 5mcf/d of gas in flare and this is the real challenge for Egypt.” According to de Lastours, the study estimated that a $2b investment is needed to bring the flaring from the existing producing fields to zero.

The EBRD has financed four oil companies – Merlon, PICO, IPR, and Kuwait Energy – in two years that have reached flaring reduction with a variety of solutions such as gas fired power generators, connecting pipeline to near-by processing plants, LPG stripping units, the banker added. The EBRD has demonstrated through these finances that “there is a business rational to recover the gas,” stated de Lastours.

According to de Lastours, the improvement in addressing flaring problems is achievable by introducing ‘gas clauses’ in all existing agreements, defining flaring regulations, monitoring and reporting on flaring, and providing preferential access to infrastructure for companies investing in gas fields. The EBRD concluded that “the main challenge is the small scale flaring and there are number of new small scale modular technologies, which are not fully deployed in Egypt,” said de Lastours.

Gas Industry Objectives and Reforms

Minister of Petroleum, Tarek El Molla opened the roundtable by defining Egypt’s major objective for the future of the gas industry. He asserted that “part of the business activities that we are doing now as oil and gas business and specifically in gas is that we are, unfortunately, importing gas and unfortunately importing LNG. And I do not think that this is one of our objectives or targets.” Egypt’s goal is to expand gas production, he added.

In his speech, El Molla stated that Egypt has been witnessing a significant development in the past years, as a result of which there emerged a necessity for the government to adopt “a strong set of integrated strategies” and search for additional energy resources. “The government has formally taken some decisive measures to further patch up the energy sector. These measures are mostly disclosed under the pillars of the new energy strategy,” said El Molla.

In line with the strategy, the government has implemented the first year of a five-year plan in energy subsidy reforms, reduced IOCs’ arrears from $6.3b to $3b, modified upstream agreements, renegotiated gas prices for the government to sign more than 64 production sharing agreements, with ten more agreements in the pipeline, accelerated oil and gas exploration projects, secured LNG imports, expanded and upgraded refineries, initiated gas market reform as the government adopted a new gas law.

Attempts to reconstruct gas industry come across numerous challenges in recent years due to fuel subsidies, growing demand, which has put increasing pressure on available fuel supplies, and disruption to investment climate that caused slowdown of exploration and production. “Critical new developments in particular in the major North Alex field, the West Nile Delta, were delayed while no new exploration and production agreements were signed between 2010 and 2013,” the Minister added. Further, “increasing field development costs in the deep water of the Mediterranean has caused further challenges,” and “contributed to flattening gas production,” said El Molla.

The government has tackled the challenges. It has accelerated production from the existing gas fields, marked new discoveries, issued new bid rounds for exploration and production under the joint venture model, signed new energy import contracts, diversified power generation mix, and adopted the new gas law.

In a concluding note, Minister El Molla said that “Egypt holds the key to the Mediterranean gas future by deciding to create a new Eastern Mediterranean gas hub based on its existing exporting infrastructure. Creating a new Eastern Mediterranean gas hub would benefit all players involved, allowing Egypt to enhance its role in the region and secure revenue from the transit scheme, and neighboring countries to fully exploit their gas reserves. It would also present an opportunity for Europe where imports requirements will grow post 2020 due to the declining domestic production and expiration of long term contracts.”

Gas Industry to Benefit from Low Oil Prices

Metas Energy President, Arshad Sufi kicked off the discussion by saying that the industry in the past year and a half has seen “a panic setting in because of dropping oil prices” that resulted in “crisis of confidence” accompanied with waiting and hoping that the prices will go up. Drawing parallels to the business tactics used at the times when a barrel of oil was traded for $18, Sufi explained that it was possible to “keep the industry lucrative, as cost of development and production was very low compared to today’s standards,” and he proposed to follow suit this time.

Minister El Molla confirmed that the government had been following this tactic by “engaging with our partners and really trying to incentify them for them to choose investing in Egypt rather than in other markets,” as recent agreements have demonstrated.

Focus on High Risk Exploration Areas

Beach Petroleum’s Country Manager, Samir Abdel Moaty, drew attention to the length of data collection on more demanding exploration areas such as the western part of the Mediterranean and the Red Sea. He proposed to encourage more companies to join in despite high risk by accelerating provision of relevant information to IOCs before acquiring concessions. This would decrease their costs and reduce the cycle time, said Moaty.

In response, GANOPE Chairman, Engineer Abu Bakr Ibrahim, stated that in the Red Sea area, the exploration activities were low and there were only seven companies expressing their interest in the area. “The seismic and geological data is very poor, so right now we are planning to acquire multi-client permission,” said the Chairman.

Minister El Molla added that the EGAS is pursuing the same steps. He said that “we are trying to do it differently, utilizing this multi-client concept, which has not been implemented before and we are working on that in order to prepare for new bid rounds whenever this study will be completed,” as the country is seeking to accelerate the process.

Gas Pricing in Liberalization Environment

Edison General Manager (GM), Maurizio Coratella, contributed to the discussion raising the issue of gas pricing. According to GM’s views, even in the $30 – $40 environment, the government can still play a major role in attracting investors. “As far as it will be capable of neutralizing the ‘gas formulas’ from the Brent affect, this could be the best message to investors, together with the arrears issues, which is the other side of the concerns,” he said. This “will definitely boost and incentify IOCs investing in the gas market.”

The Oil Minister said that Egypt is facing “the current challenge of reducing a big portion of arrears nowadays,” having promoted the issue to the top levels of government’s and presidency’s agenda.

Gas Market Liberalization

ENGIE’s Managing Director (MD), Johannes Finborud, stressed that the industry was in a bad situation due to oil price developments, and that “has affected the room for maneuver for companies that also operate in Egypt” due to limited cash flow. He proposed to create market oriented approaches along the lines of market liberalization so that the gas industry investors will be able to sell gas freely. In addition, MD Finborud noted that “with the development going forward, we need to look at more long term solutions, so that the companies can form partnerships with private companies here in Egypt,” which he thinks “is going to be the key to continue investments from foreign companies.”

In his comment on the pace of the gas market liberalization processes, Minister El Molla stated that Egypt had started the implementation of deregulation phases in the gas sector in early 1990s. The energy subsidy “has grown to an extent that it has become like a taboo that nobody is able to touch,” and this was sidelining “the price of commodity itself, which is something that is not sustainable and is not reformed,” said the Minister.

In light of the developments, Egypt projected LNG imports, however, the country has “not received a series of fully compliant independent importers of gas,” according to the Minister. This was a step forward, which needed to include the role of the gas price itself, but this turned out to be a weak point. The Minister emphasized that for any further deregulation processes, there is a need to “pave the way and prepare the ground to a fully deregulated independent market” by facilitating the restructuring, diversification, or IPOs. In regard to the gas sector deregulation program, the minister concluded that “this first phase, which is industry and domestic usage, except electricity, can be done in the coming two three years.”

In concluding remarks on the liberalization processes, EGA Chairman, Abu Bakr, emphasized that on the way towards a sustainable market, “the government and the stakeholder of the industry are in total agreement about the direction. What is very important and positive is that both sides, IOCs and the government, see the importance of not committing mistakes on the liberalization.”

Integrated Gas Strategy

In addition, PICO International Petroleum CEO, Ian Hewitt, noted that for the country to achieve a sustainable market, “there needs to be a properly integrated gas pipeline for the companies, probably for the five to ten year time frame.” This would also allow Egypt to establish itself as a regional gas hub.

According to El Molla, the government is pursuing two key activities in order to fulfill this ambition. The goal is to increase gas production in five to ten years. “We are focusing on issuing very careful bid rounds whereby we make sure that we meet the expectations of bidders and partners, therefore we move to have discussions before issuing bid rounds in order to hear and listen to their thoughts regarding the areas where we can tender for,” which will define the volume of exploration activities, affect future discoveries and ultimately production, the Minister reiterated.

As a result of instability, the gas sector has seen delays in projects implementation leading to a sharp decline in production, up until now, said the minister. Therefore, “we had to take a decision of starting importing LNG, which is not sustainable, and it is not our ultimate goal,” the Oil Minister, El Molla, explained. The government’s target for the upcoming period of five years is to address the supply-demand disparities in the gas sector.

“The government is also putting up aggressive plans in increasing power generation, matching those together, we see that with the big discovery of Zohr, with North Alex, and other numerous developments with each of your companies, we will still be importing gas up until year 2021, and even 2022,” El Molla clarified. Therefore, “adding big volumes in production will not close the gap between needs in the domestic market and our production, however, it will reduce the level of importation”, the minister added. The government is currently updating the strategy looking beyond 2022, aiming at ultimately eliminating the imports.

Implementing Energy Mix

Introducing another aspect of the market liberalization, Kamel El Sawi, the Country Manager (CM) for Kuwait Energy in Egypt, promoted a change in the energy mix to help the government start the liberalization. Currently, oil and gas industry is representing 90% of energy mix in Egypt. In attempts to reduce budgetary burden on the Petroleum Ministry, El Sawi proposes to reduce the portion to the maximum of 50%.

The Petroleum Minister informed that the Ministry of Electricity had been implementing the 2025 strategy by reducing power generation dependence on oil and gas by 70%. Furthermore, the ministry is also transforming all its open and simple cycles to combine cycles with the renewables as well as encouraging other activities aiming for nuclear-, coal-, and solar-powered plants, explained El Molla, which is estimated to come online within less than ten years, projected the minister.

Concluding Remarks

H.E. Dr. Hamdy El Banbi, EGA’s Honorary Chairman, concluded that in the gas industry, “the challenges are still the same.” He suggested further that Egypt should “work on all the challenges, which were mentioned today, in parallel.” “We try to minimize the costs, we try to increase production, we try to do liberalization from one part or another, but we should not wait until everything is well established,” instead continue working on all areas simultaneously, Dr. El Banbi reiterated. “One of the most important things to do at present time is to concentrate on increasing production at minimal cost,” as he concluded.

In a closing note, Engineer Abu Bakr confirmed to the audience that EGA “will do our utmost effort to continue this opening channel of discussion and building together a positive way.” He expressed the view that “Egypt is the best country so far at this stage in the area available for investment and increasing its investment in oil and gas.”

The Chairman took the opportunity to announce that the EGA was honored to award Honorary Membership to Minister El Molla.