Global Economy

Currently, CEOs are less optimistic about global growth prospects than they were a year ago, with only 37% of CEOs expecting global economic growth to improve in 2015. High hopes have decreased from last year’s 44%. Furthermore, 17% of CEOs believe global economic growth will decline, a number that more than doubled since last year (7%). The remaining 44% expect economic conditions to remain steady.

Regionally, the results show wide variations. CEOs in the Asia Pacific are the most optimistic about the global economy, with 45% anticipating improvement, followed by the Middle East (44%) and North America (37%). On the other hand, only 16% of CEOs in Central and Eastern Europe expect economic improvement. CEOs in emerging economies like India (59%), China (46%) and Mexico (42%) are more optimistic about the economy than those in developed economies like the US (29%) and Germany (33%).

Revenue Growth

Despite the grim outlook of the global economy, CEOs remain confident of high prospects for their companies. A sweeping 39% of CEOs worldwide said they are ‘very confident’ that their company’s revenues will grow in the next 12 months; slightly higher than the 36% figure in 2013.

What worries CEOs most?

Over-regulation tops CEOs’ list of concerns, as reported by 78% of CEOs worldwide. This is up six points from last year and is now at the highest level ever seen in the survey. Other top concerns cited by CEOs are availability of key skills (73%), fiscal deficits and debt burdens (72%), geopolitical uncertainty (72%), increasing taxes (70%), cyber threats and lack of data security (61%) – going up rapidly from 48% last year – as well as social instability (60%), shifting consumer patterns (60%) and the speed of technological change (58%). CEOs concerns are high in all areas compared to last year, with the exception of energy costs where concerns have slightly decreased to 59%.

Working with the Government

CEOs say the government’s top priority should be to maintain a competitive and efficient tax system, according to 67% of survey respondents, but only 20% of CEOs said their country has been successful in creating such a system. Likewise, access to a skilled workforce is valued by 60% of CEOs, but just 21% say enough skilled workers are available in their country. Other government priorities according to CEOs include physical infrastructure (49%), affordable capital (29%), and digital infrastructure (28%). The pressing issue of reducing the risks of climate change is not given sufficient priority, with only 6% or respondents considering it a relevant issue.

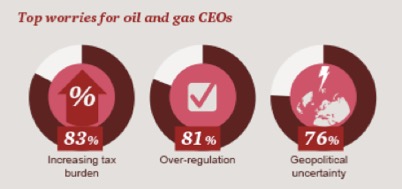

Oil & Gas CEOs are facing tough market conditions, but CEOs are striving to find prospects for growth by maximizing technology investments, improved utilizing partnerships and diversity strategies. The industry is facing an oversupply and lower prices – so it is not surprising that nearly two-thirds of oil and gas CEOs say their companies are facing more threats against growth than they did three years ago. For oil and gas companies, a rising tax burden, over-regulation and geopolitical uncertainty tops the list, followed by governmental response to fiscal deficit, debt burden and protectionist tendencies from national governments. Taxes are a particular issue for the sector. An internationally competitive and efficient tax system is rated as CEOs’ top expectations from the government.

Power & utilities CEOs are cautious about the financial outlook; only 29% think the economy will improve this year, compared to 37% of the overall sample. The CEOs in the power and utilities sector are less confident of increasing revenues in the short or mid term than CEOs in other sectors.

What accounts for this wariness? Power & utilities CEOs are acutely conscious of how global megatrends are disrupting the entire business landscape and the profound implications on their industry. They are bracing themselves for shifts in the way customers behave, competition from new entrants, as well as traditional rivals and changes in their core production technologies. But it is the prospect of regulatory upheavals that worries them the most; 89% are weary in this regard, as compared to 66% overall. The fact that power and utilities are actively restructuring their operations is also revealing of such concerns. The percentages planned to in-source previously outsourced processes or functions and to exit major businesses or markets this year, is noticeably higher than the total sample – a clear sign that they’re preparing for instability.

Mining CEOs are more hesitant about economic outlook than their counterparts in other industries. Only 16% of them believe outlook will improve in the coming 12 months, compared to 37% of the overall sample. But they are as confident of being able to generate higher revenues in the future. They’re looking up to China to generate much of this growth, but they are also looking to the US and India. We see mining CEOs looking to simplify their business models and focus on their core properties. Maintaining a reign on costs is a key priority for mining CEOs; 72% say they will implement a cost reduction initiative over the next 12 months.

COMMENTING ON THE SURVEY RESULTS

Dennis M. Nally, Chairman of PricewaterhouseCoopers International, says:

“The world is facing significant challenges: economically, politically and socially. CEOs overall remain cautious in their near-term outlook for the worldwide economy, as well as for growth prospects for their own companies. While some mature markets like the US appear to be rebounding, others like the Eurozone continue to struggle. And while some emerging economies continue to expand rapidly, others are slowing. Finding the right strategic balance to sustain growth in this changing marketplace remains a challenge.”

“CEO confidence is down notably in oil-producing nations around the world as a result of plummeting crude oil prices. Russia CEOs, for example, were the most confident in last year’s survey, but are the least confident this year. Confidence also slipped among CEOs in the Middle East, Venezuela, and Nigeria”.