US | Egypt Oil & Gas - Part 18

BP to Begin Paying Settlements to Local Governments for Deepwater Horizon Spill

A federal judge says BP will begin paying up to $1 billion in settlements to compensate local governments across the Gulf Coast for lost tax revenue and other economic damages they blame on the company's 2010 oil spi ...

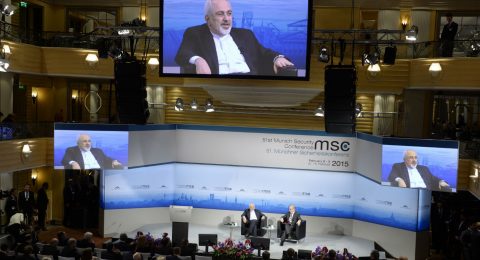

Iran Nuke Deal Reached, Governments and Corporations Measure Ramifications

Iran and six world powers reached an agreement on Tuesday to lift sanctions against the Islamic Republic, and while U.S. and Iranian leaders have heralded the deal as a victory, the real winners could be corporations ...

Iran Targeting US Market for Petrochemicals, Following Nuke Deal

Iran has worked out a “special plan” for exports of petrochemical products to the US, secretary of the Association of Petrochemical Industry Corporations (AIPC) Ahmad Mahdavi said on Monday

Iran Challenges US Catalyst Monopoly

Iran has achieved technical know-how for production of catalysts used by isomerization units of oil refineries, putting an end to the United States’ monopoly in the field.

UAE’s Environmentally Friendly Cooling Systems on International Display

A delegation from Emirates Central Cooling Systems Corporation (Empower), a leading district cooling services provider, is heading to Boston, US to take part in the 106th International District Energy Association (I ...

Oil Prices Fall as US Dollar Strengthens

Oil prices ticked lower Monday on a stronger dollar and weak Chinese manufacturing data.

Shale Stocks Drop as Major US Investor Criticizes Industry

Money manager David Einhorn slammed the shale drilling industry that ushered in a new era of U.S. oil production as wasteful, expensive and a terrible investment.

Iran and US Trade Claims Over Oil Contracts, Meetings Claims

The US State Department says it cannot confirm a report that an American oil delegation plans to visit Tehran within the next few days to discuss business.