Eni has sold a 10% stake in Egypt’s Shorouk offshore concession to Mubadala Petroleum for more than $1 billion, Egypt Oil & Gas reports.

The Emirati company agreed to pay Eni $934 million for the stake in addition to a $94 million signing bonus.

Eni’s holdings in the concession have been reduced from 60% to 50% following the deal. Shorouk’s other stakeholders are Rosneft, which owns 30% of the concession, and BP, which holds the remaining 10%.

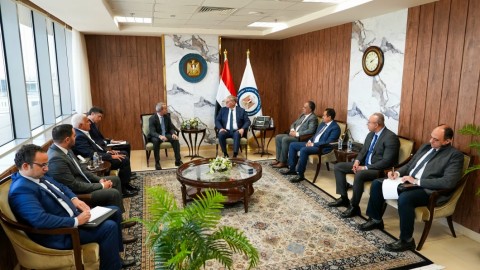

The final agreement was signed on June 20 by Egyptian petroleum minister Tarek El Molla and representatives from Eni, Mubadala, and the Egyptian Natural Gas Holding Company (EGAS).

Following the signing of the agreement, El Molla said that the deal demonstrates the attractiveness of the Egyptian economy to international investors.

Mubadala Petroleum is a subsidiary company of the state-owned Mubadala Investment Company. The portfolio of the Abu Dhabi-based investment company is worth over $125 billion.