bp has signed a $1 billion deal with Apollo-managed funds to purchase a non-controlling stake in bp Pipelines TAP Limited, a subsidiary of bp that holds a 20% share in Trans Adriatic Pipeline AG (TAP).

Once completed, bp will remain the controlling shareholder of bp Pipelines TAP Ltd.

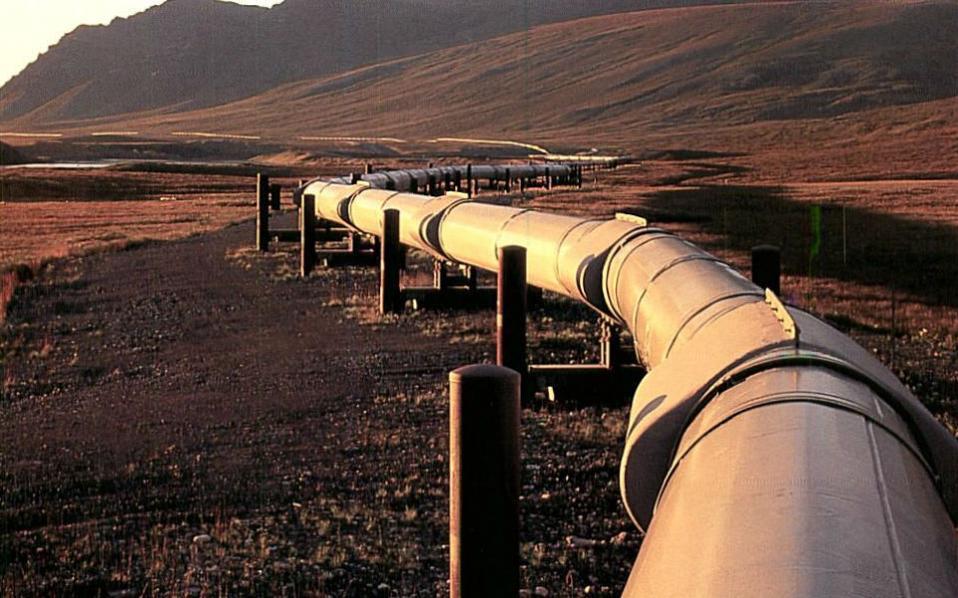

Trans Adriatic Pipeline AG is the owner and operator of a critical infrastructure asset for meeting European energy demand. The pipeline is the final 880-kilometre leg of the Southern Gas Corridor pipeline system, transporting natural gas from the bp-operated Shah Deniz gas field in the Azerbaijan sector of the Caspian Sea to markets in Europe, including Greece and Italy.

bp said that proceeds from this transaction will contribute to the company’s 2024 divestment and other proceeds target of $2-3 billion, part of the company’s disciplined financial framework.

Notably, the transaction is expected to close in the fourth quarter of 2024, subject to customary regulatory and partner approvals required.

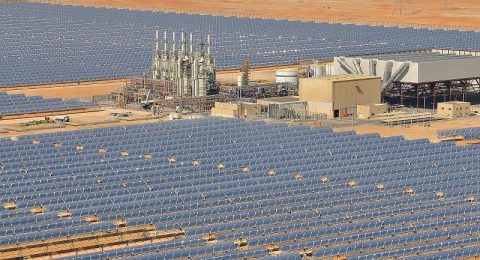

bp also stated its plans to partner with Apollo on additional investment opportunities, including potential co-operation in both gas and low carbon energy assets, and infrastructure.

“We are very pleased to come together with Apollo on this key piece of Europe’s energy infrastructure. Importantly, while bringing in a new investor, this does not diminish bp’s role in a strategic asset for our Azerbaijan gas business,” said William Lin, bp EVP of gas and low carbon energy.

For his part, Skardon Baker, Apollo Partner said; “We are pleased to partner with bp on an agreement that will provide our investors with long-term exposure to an industry-leading infrastructure asset with a stable cash flow profile, while allowing bp to meet its objectives of retaining control and executing on its capital efficiency strategy.”

In the same context, Leslie Mapondera, Apollo Partner said: “Together, we see more potential opportunities, as we look to leverage Apollo’s long-term capital and sustainability & infrastructure investment expertise to partner with bp on its strategic plans, including energy transition opportunities.