Egypt Plans More Oil Hedging Contracts

The Egyptian government is planning to double the number of crude oil hedging contracts for fiscal year (FY) 2019/20.

The Egyptian government is planning to double the number of crude oil hedging contracts for fiscal year (FY) 2019/20.

Prices for Asia are affected by the monthly average price of Platts Dubai and the Oman Dubai Mercantile Exchange (DME).

Egypt plans to apply an oil hedging mechanism in fiscal year (FY) 2019/20 that starts in July after its efforts to lock-in oil prices in the FY 2018/19.

The petroleum and finance ministries are adjusting the hedging mechanism for fiscal year (FY) 2019/2020 in line with recent global oil prices.

Russia is growing concerned of a scenario that could see crude oil prices drop to as low as $30 a barrel if the OPEC-led output deal is not extended.

Concerns regarding crude supplies as well as the geopolitical tensions in the Middle East led to a surge in the global oil prices by more than 2%.

The budget for fiscal year (FY) 2019/20 estimates oil prices at $68 per barrel, down from $70 of in FY 2018/19.

The oil market is balanced, and current oil prices are fair, according to Talal Al-Sabah, Kuwait’s Acting Deputy Oil Minister.

The Egyptian government is taking a hedging mechanism against oil and food commodities price fluctuations in fiscal year (FY) 2018/19.

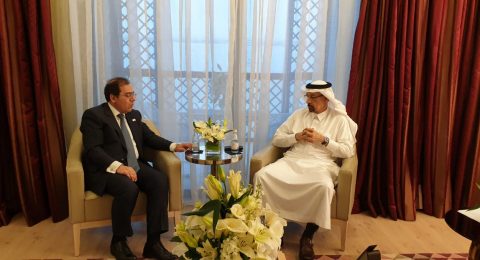

El Molla and Al-Falih met on the sidelines of the World Economic Forum on the Middle East and North Africa that is taking place in Jordan on April 6-7.