SLB has announced its third-quarter results (3q24), achieving a notable revenue of $9.16 billion, a 10% increase year-on-year, despite a cautious macroeconomic environment.

Net income attributable to SLB, excluding charges and credits, rose 13% to $1.27 billion in the three months ending September 30. Excluding charges and credits, per share profit was 89 cents, compared with a consensus estimate of 88 cents.

According to SLB’s third quarter report, these results were driven by the company’s focus on cost optimization, greater adoption of digital products and solutions, and the contribution of long-cycle projects in deep water and gas.

“This performance was achieved despite an environment where short-cycle activity growth softened, and some international producers exercised cautious spending triggered by lower oil prices and ample global supply, while land activity in the US remained subdued. Revenue grew in the Middle East & Asia and offshore North America but was offset by a decline in Latin America, while Europe & Africa held steady,” said SLB’s CEO, Olivier Le Peuch.

The company reported a 4% sequential increase in Digital & Integration revenue, with its digital business growing by 7% sequentially and 25% year-on-year.

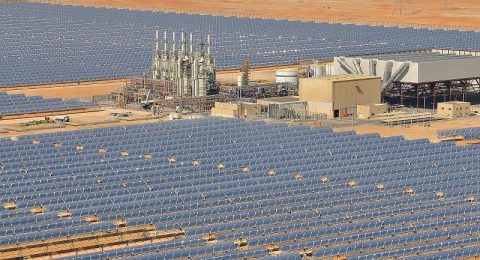

SLB, which gets 81% of its business from overseas markets, said international revenue last quarter grew 12% on the year, helped by increased sales in Saudi Arabia, the UAE, Iraq and Kuwait, as well as in North Africa, offsetting reduced drilling activity in Mexico and Guyana.

The company anticipates delivering strong cash flows and maintaining an adjusted EBITDA margin of 25.6%, a 55-basis point sequential increase.

SLB has recorded Cash flow from operations at $2.45 billion, with free cash flow reaching $1.81 billion.

SLB also returned close to $900 million to shareholders through stock repurchases and dividends during the quarter, bringing the total return to shareholders for the first nine months of the year to $2.38 billion.

The company repurchased 11.3 million shares of its common stock for a total purchase price of $501 million in the third quarter alone.