Egypt is undergoing a fundamental structural transformation in its petroleum and natural gas sectors. A recent report by Rystad Energy, an Oslo-based leading independent energy research and business intelligence company, highlighted how the country leads globally in licensing rounds for 2025-2026, addresses overdue payments to international oil companies (IOCs), and reforms gas pricing to foster partnerships.

Those efforts have stabilized production and restored investor confidence, positioning Egypt as a partner of choice for energy investment in Africa.

Building on this foundation, the report, titled “Egypt’s Gas Reset: Clearing Debts, Reviving Drilling, and Scaling Renewables,” highlights the government’s proactive stance in balancing production rates while accelerating the search for discoveries.

Despite recent supply challenges, including declining output from Zohr, the government has demonstrated an unprecedented level of engagement to secure the nation’s energy future, according to the report.

Tackling Debt, Regaining Confidence

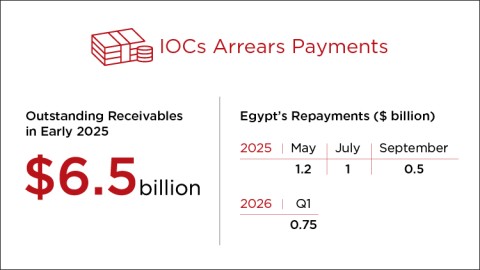

A cornerstone of this “reset” is the effective management of the receivables challenge, which directly paves the way for renewed investment. Debt owed to international partners declined steadily throughout 2025, supported by a structured financial plan extending into early 2026. Outstanding receivables to IOCs stood at $6.5 billion at the start of 2025.

The government has made gradual payments, including $1.2 billion in May, $1 billion in July, nearly $500 million in September, and plans for a further $750 million payment throughout Q1 2026 in two phases. This structured repayment reduces financial strain, rebuilds trust, and enables resumed drilling programs for sustainable output growth.

These financial measures have enabled Egypt to adopt what the Rystad report describes as a genuine “partnership model,” contrasting it with the rigid “take-it-or-leave-it” contractual approaches often seen in other African producing nations. This shift is most evident in the government’s willingness to revisit gas-pricing structures and merge concession agreements to improve operational scale.

Building directly on these reforms, Egypt addressed onshore operators’ concerns over fixed pricing that ignored inflation by consolidating concessions and introducing incremental gas pricing. Gas prices for APA Corporation ( the holding company Apache), Egypt’s largest onshore producer, are set to average $3.58 per thousand cubic feet (Mcf) in 2025, up 18% from $2.94/Mcf in 2024, with $3.90/Mcf expected in the fourth quarter (Q4), according to Rystad.

Onshore and Offshore Momentum

On the one hand, onshore activity shows robust recovery as a result. APA Corporation reported quarter-on-quarter production growth exceeding its 2024 average of 444 million cubic feet per day (MMcfd), reaching 515 MMcfd in recent quarters, fueled by outperforming new gas wells. Dana Gas launched a $100 million program for up to 11 wells, targeting 80 billion cubic feet (Bcf) of recoverable gas, plus prospect testing and well recompletions. These efforts contribute fresh volumes, countering declines in legacy fields.

On the other hand, offshore exploration hits unprecedented levels, with major IOCs committing heavily to complement onshore gains. BP signed agreements for up to five Mediterranean wells with EGAS to expand reserves. Eni plans $9 billion investment over four years in Zohr and adjacent areas. Chevron, Shell, and Eni won blocks in recent bid rounds, while QatarEnergy took a 27% stake in North Cleopatra with Shell. This aligns with Egypt’s strategy to intensify search efforts and halt production declines.

Global Leader in Licensing

This surge in activity is underpinned by Egypt’s position as a global leader in licensing, excluding China and Russia, ranking fifth worldwide since 2020 with 10 completed bid rounds and leads globally for 2025-2026 via ongoing, planned, open, and awarded rounds.

The dual-track approach features the Red Sea offshore round with enhanced seismic data and the Open Blocks Licensing Program (OBLP), offering year-round access to 27 blocks in the Mediterranean, Nile Delta, Gulf of Suez, and deserts. The Egypt Upstream Gateway (EUG) boosts transparency and speeds decisions, making Egypt one of the world’s most dynamic regimes.

Production Outlook and Renewables Role

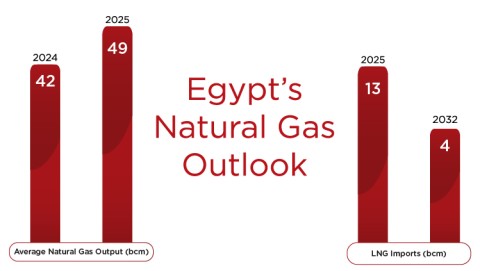

Despite positive upstream developments (debt clearance, new drilling, investments), Egypt’s natural gas production has temporarily stabilized at 3.5 Bcm per month during the final quarter of 2025—offering short-term relief from earlier declines.

However, the full-year 2025 average will still be lower at just over 42 Bcm annually (roughly 3.5 Bcm/month average), representing a year-over-year drop from 49 Bcm total in 2024, and far below the recent all-time peak of 70 Bcm. LNG imports rise to 13 Bcm in 2025 from 4 Bcm in 2024.

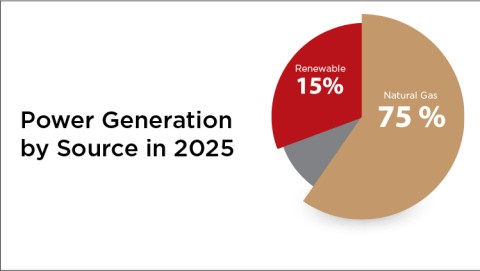

In Rystad’s base case scenario to 2040, the power generation mix evolves with renewables (solar PV, onshore wind, hydro, bioenergy) rising from ~15% currently to 24% by 2030, while natural gas remains dominant, 75%, alongside declining fossil liquids and emerging nuclear capacity. This includes ~13.7 GW of new solar photovoltaics (PV), wind, and battery energy storage systems (BESS) capacity added in the period 2026-2030, despite grid constraints limiting support to 36 GW against 180 GW potential land bank.

The report’s high-renewables scenario—an optimistic case for accelerated rollout—adds 40 GW of solar, wind, and battery storage by 2030, boosting renewables’ share to 46% of total power generation (vs. 24% base case) and slashing gas-for-power demand to 27 Bcm annually (down from 39 Bcm base case). This frees up gas volumes for export next decade, supported by Israeli pipeline supplies plus Aphrodite and Cronos fields meeting domestic needs—no LNG imports required; achieving Egypt’s 42% renewable electricity target demands $5-6 billion grid upgrades, international financing, and streamlined regulations.

The Egypt Model of energy management—defined by debt transparency, flexible pricing, and digital accessibility—now serves as a blueprint for regional peers. By fostering a collaborative environment with majors like Shell, Chevron, and Eni, Egypt is not only securing its domestic requirements but is also solidifying its role as the premier energy hub of the Eastern Mediterranean.