The Egyptian Propylene & Polypropylene Company (EPPC) is aiming to collect $300 million from the initial public offering (IPO) in the first quarter of 2018, Amwal Al Khaleej’s Country Head, Mena Private Equity Firm, Karim Saada, told Daily News Egypt.

The company assigned EFG Hermes to manage the IPO listing.

The aim of the IPO is to secure sufficient funds for EPPC’s expansion plans of its petrochemical plant as Amwal Al Khaleej eyes increasing the plant’s production capacity from 290,000 tons between three or four year to be 600,000 tons per annum.

The petrochemical plant is going to receive $1 billion investments for its expansion during the first quarter of 2018, Saada stated.

Amwal Al Khaleej Company owns 15% of EPPC, which has a current capital estimated at $276 million, according to Arab Finance.

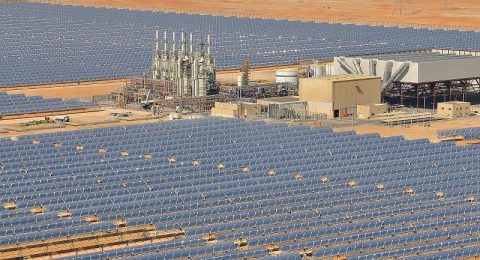

EPPC’s propylene and polypropylene (PP) complex is located in Port Said, about 170km north-east of Cairo, Egypt.