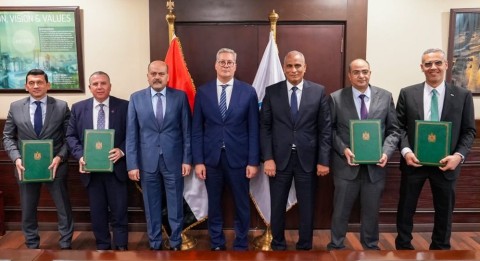

Aramco, a global leader in integrated energy and chemicals, has signed a $11 billion lease and leaseback agreement for its Jafurah gas processing facilities with a consortium of international investors, led by Global Infrastructure Partners (GIP), which is part of the global investment management company, BlackRock.

Under the agreement, a newly established entity named Jafurah Midstream Gas Company (JMGC) will assume the development and operating rights for the Jafurah Field Gas Plant and the Riyas NGL Fractionation Facility, which it will then lease back to Aramco for 20 years. In return, Aramco will pay JMGC a tariff, securing exclusive access to process, treat, and receive raw gas from the Jafurah field.

An Aramco press statement explained that the company will hold a 51% share in JMGC, while the consortium will hold the balance. It noted that this deal will not impact Aramco’s production volume and is expected to be completed soon, pending customary closing conditions.

Jafurah represents Saudi Arabia’s largest non-associated gas development, holding an estimated 229 trillion standard cubic feet (tsf) of raw gas and around 75 billion stock tank barrels of liquids. It plays a central role in Aramco’s strategy to boost gas output by 60% between 2021 and 2030 to address growing demand.

“Jafurah is a cornerstone of our ambitious gas expansion program, and the GIP-led consortium’s participation as investors in a key component of our unconventional gas operations demonstrates the attractive value proposition of the project. We look forward to Jafurah playing a major role as a feedstock provider to the petrochemicals sector, and supplying energy required to power new growth sectors, such as AI data centers, in the Kingdom,” Amin Nasser, Aramco President & CEO, said.

“We are pleased to deepen our partnership with Aramco with our investment in Saudi Arabia’s natural gas infrastructure, a key pillar of global natural gas markets. Today’s announcement builds upon BlackRock and GIP’s longstanding relationship with Aramco to serve growing market needs for cleaner fuels, energy security, and energy affordability,” Bayo Ogunlesi, Chairman and CEO of GIP, said.

GIP is a mid-market infrastructure equity team that invests in diversified and contracted mid-market infrastructure assets and businesses around the world. It has built a strong history of long-term, successful investments across the Middle East.