Egypt, once a net exporter of natural gas, is now grappling with a significant energy challenge caused by natural gas shortage. This situation has put immense pressure on the nation’s electricity grid, particularly during the peak summer months when demand for air conditioning soars. To address this critical issue and ensure a stable power supply for its citizens and industrial sector, the Egyptian government is pursuing a multi-faceted strategy.

Grappling with Limited Availability

Despite government policies promoting greater gas utilization, supported by international backing for gas as a “transition fuel,” Egypt’s natural gas production has been declining over the past two years. In May 2023 Egypt produced 3.799 (mmt tons) of natural gas, a year later it produced 3.2316 mmt In May 2025 the output came at 2.6654 mmt according to the Central Agency for Public Mobilization and Statistics’ (CAPMAS) Monthly Statistical Bulletin.

Additionally, The Zohr field, Egypt’s primary source of gas, has experienced a significant decline in production since 2022, a consequence of water infiltration, as mentioned by Alternative Policy Solutions Website, a non-partisan, public policy research project at the American University in Cairo, in March 2025.

In order to accelerate production and encourage exploration companies, the (MoPMR) has been keen to settle arrears to international oil companies (IOCs). In this regard, Prime Minister Mostafa Madbouly announced in July 2025 that the Egyptian government had repaid over $1 billion of its debts to IOCs operating in the country. The country plans to settle an additional $1.4 billion before the end of 2025, according to Madbouly.

The situation is further complicated by a reduction in gas imports from Israel. In mid-May, Israel began routine maintenance on a key export pipeline, causing a temporary decrease in supply to Egypt. Natural gas supply was further impacted by the war between Iran and Israel which led to a temporary halt of major Israeli natural gas fields’ operations.

The volume of Israeli gas supplied to Egypt has been 1 billion cubic feet per day (bcf/d), according to Asharq Al-Awsat. The Israeli natural gas supply to Egypt experienced an interruption in June 2025 due to Israeli military actions against Iran, which prompted Israel to shut down two of its three offshore gas fields as a precautionary measure. This led to a six-day halt in gas exports from Israel to Egypt starting on June 13. The supply to Egypt resumed on June 19 but initially only at reduced levels, mainly from the Tamar gas field, as larger fields like Leviathan remained offline. By late June, following a ceasefire between Israel and Iran, Israeli gas flows to Egypt gradually returned to normal levels, reaching the previously typical export volume of around 1 bcf/d.

Multi-tracked Approach to Secure Supply

In 2024, Egypt started diversifying its natural gas and LNG import suppliers to ensure covering local demands. The country imported around $4.9 billion worth of natural gas and LNG from different countries, namely, Israel, the United States, Nigeria, Spain, Guinea, and France, according to the World Bank’s World Integrated Trade Solution (WITS).

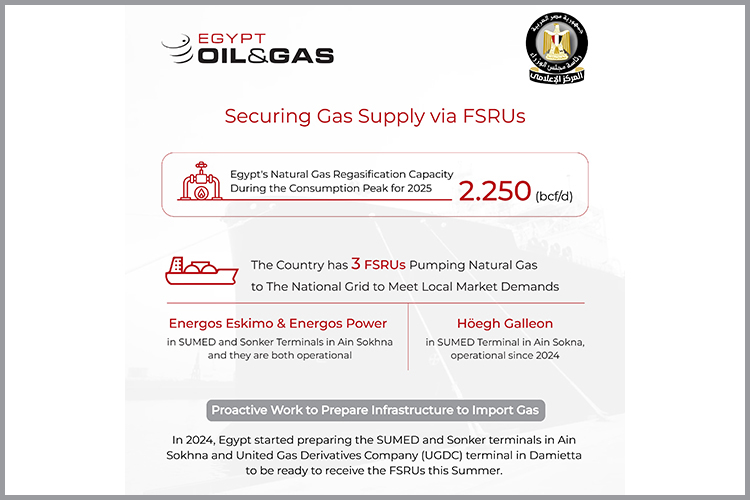

As part of the state’s proactive plan to increase production and secure the nation’s energy needs, floating storage regasification units (FSRUs) have been brought in. These units represent a strategic addition to diversify the inputs into the national natural gas grid. In parallel, work has been underway to prepare several new docks and connect them to the national gas grid. This will help enhance the state’s ability to safely and sustainably secure all the natural gas needs for the electricity sector as well as various industrial and economic sectors.

In late July 2025, Egypt’s natural gas Regasification capacity during the consumption peak for 2025 reached 2.250 billion cubic feet per day (bcf/d). The country has three FSRUs, namely Höegh Galleon; Energos Eskimo; and Energos Power, pumping natural gas to the national grid to meet local market demands, according to the Egyptian Cabinet. Moreover, in July, Egypt leased the Energos Winter FSRU for five years, with expectation for the FSRU to arrive at Damietta port in August 2025.

The country started in 2024 preparing terminals like SUMED and Sonker in Ain Sokhna and the United Gas Derivatives Company (UGDC) terminal in Damietta to be ready to receive the FSRUs this Summer.

Egypt has further secured an additional source of natural gas through a cooperative effort with Jordan. The Energos Force FSRU has been deployed to Jordan’s Port of Aqaba in July, where it will connect to the Arab Gas Pipeline (AGP). This connection allows for the transport of natural gas to countries linked by the pipeline, including Egypt, Jordan, Syria, and Lebanon, providing a new supply channel for the region.

Moreover, in February 2025, Egypt, Cyprus, and Chevron signed a memorandum of understanding (MoU) to finalize important commercial details for the Aphrodite gas project. The plan for this project involves a Floating Production Unit located in Cyprus’s Exclusive Economic Zone (EEZ) and a pipeline to transport the natural gas to Egypt. Frank Cassulo, Vice President, Chevron International Exploration & Production, commented on the MoU stating that “Chevron and our Joint Venture partnership remains committed to developing and advancing the Aphrodite project, which is a significant resource for Cyprus and an important part of Chevron’s Eastern Mediterranean portfolio as well as providing natural gas supplies to Egypt to help meet the country’s growing energy demand.”

Recent gas exploration and discoveries in Egypt signal an active effort to boost domestic production amid growing energy demand. In 2025, Egypt signed new gas exploration deals with major international companies Eni and bP to explore areas in the Mediterranean Sea, including drilling exploratory wells in the Temsah concession and the Raven gas field. bP accelerated production from two new wells in the Raven field, expected to add up to 200 million cubic feet of gas per day (mmcf/d), ahead of schedule. Moreover, Egypt’s Ministry of Petroleum awarded seven new exploration blocks to various companies, planning to drill at least 17 new exploratory wells to enhance production capacity. The Ministry also launched a 2024 international bid round to attract investment in 12 new gas and oil blocks in the Mediterranean and Nile Delta regions.

On the other hand, Egypt is working on its renewable energy resources. In June 2025, Minister of Electricity and Renewable Energy Mahmoud Essmat announced that Egypt is accelerating its renewable energy efforts. As part of a comprehensive strategy to diversify the nation’s energy mix and enhance grid stability, the government plans to add approximately 2,000 megawatts (MW) of new capacity from renewable sources, representing investments of around $2.3 billion.

Egypt’s transition from a natural gas exporter to an importer highlights the significant challenges the nation faces in meeting its domestic energy needs. The government’s proactive strategy, which includes diversifying import sources, investing in new FSRU infrastructure, and securing long-term partnerships, is essential for stabilizing the country’s energy supply. While declining production from key domestic fields and regional geopolitical factors have complicated the situation, these strategic initiatives demonstrate a clear commitment to ensuring a reliable and sustainable supply of natural gas for Egypt’s future.