Egypt’s role as a host for COP27 has been a catalyst for the government’s decision to issue a new bill for a law offering incentives for projects involving green hydrogen and its derivatives. The law shall aim to accelerate the deployment of such projects in Egypt, with the country relying on its status as one of the world’s leading locations for green hydrogen production.

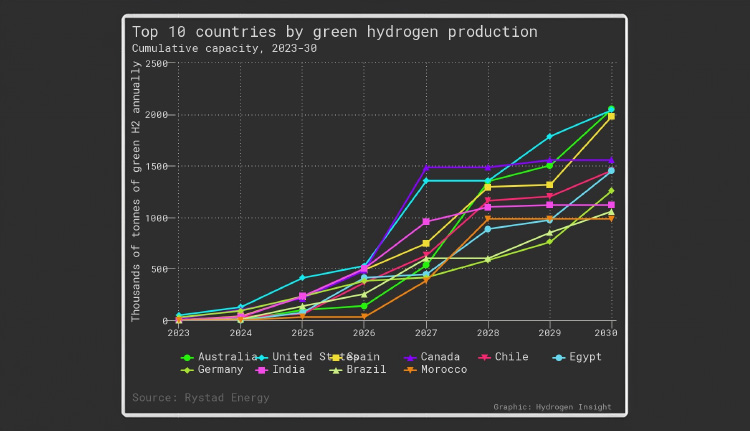

The London-based Energy Industries Council’s latest Africa Projects and Markets Update has identified $200 billion of energy projects in the pipeline for Egypt looking out to 2030 of which $70 billion are marked as “energy transition” contracts. Egypt is clearly on the road to a global top 10 position in the green hydrogen production league.

Paving the Way to Becoming a Leading Energy Hub

On May 17, 2023, the Egyptian Cabinet, presided by Prime Minister Mostafa Madbouly, approved a new bill regarding incentives for projects involving green hydrogen and its derivatives.

On June 14, 2023, the Minister of Petroleum and Mineral Resources Tarek El Molla, in a panel held in London, discussed the energy transition and use of green hydrogen, further emphasizing the keenness of the Egyptian government on soon ratifying the new law. The minister noted that the government is finalizing the national green hydrogen production strategy while taking into account a governance structure compatible with the best international practices in order to make it economically viable for investors.

The Purpose of the Law:

The legislation is intended to encourage environmentally friendly initiatives and applies to projects involved in the production of green hydrogen and its derivatives, provided that agreements are concluded within five years from the date of the law coming into force.

Scope of the Law:

The projects which shall benefit from the incentives under the law are as follows:

- Projects aiming at the production of green hydrogen and its derivatives,

- Water desalination facilities that dedicate a portion of their output to green hydrogen and its derivatives,

- Renewable energy facilities that allocate at least 95% of their output to feed green hydrogen production, derivatives production and water desalination facilities,

- Projects targeting the distribution, storage, and transportation of green hydrogen and its derivatives produced inside Egypt,

- Projects that manufacture the necessary components and supplies used in green hydrogen production and,

- Future expansions to ongoing projects, where “expansion” is defined as any improvement that boosts green hydrogen output.

Requirements:

In order to be eligible for the incentives outlined in the law, the following requirements should be satisfied:

- The maximum duration of the project cannot exceed a period of fifty (50) years.

- The project should commence its commercial operations within a period of five (5) years from the date of the conclusion of the agreements.

- The project or its expansions should rely on foreign investment of at least 70% of the investment cost for financing its operations and which should be transferred from outside Egypt.

- The projects should source at least 20% of their production inputs from domestically produced components to the extent that it is available in Egypt.

- The project should contribute to the localization and the transfer of modern and advanced technology to Egypt.

- The project shall be committed to developing and implementing training programs for Egyptian workers.

- Corporate social responsibility programs should be developed and implemented in the areas where the projects are taking place.

Incentives:

The projects meeting the above mentioned requirements should benefit from certain financial and non-financial incentives. These incentives will also apply to expansion contracts that are signed within seven years of the project’s start of operations commercially, as follows:

- A tax credit of 33-55% on revenues made from the production of green hydrogen and its derivatives

- (The Cabinet shall issue the necessary decrees to regulate the criteria and implementation thereof.)

- Exemption from value-added tax (VAT) on equipment, machines, vehicles (not including passenger cars) and materials purchased and which are necessary for the project.

- Exports from green hydrogen projects and derivatives are subject to VAT at a rate of 0%

- A waiver on taxes and fees relating to company and land registration, as well as those due on setting up credit facilities and mortgages.

- The projects shall be entitled to obtain the Golden License for the project under the Investment Law no 72/2017 and which shall include obtaining building permits or any licenses pertaining to the operation or the management of the project in a single step.

- Freely importing and exporting equipment, machinery, raw materials, vehicles and spare parts necessary for the project without the need to be registered at the Importers/ Exporters Register.

Conclusion:

Egypt has witnessed major challenges in recent years. However, Egypt’s strategic location and natural resources give it an advantage. In addition, with such major legislative reforms promoting and supporting FDIs, we are optimistic about the country’s ability to overcome the current economic turbulence.

Note:

Helal & Fraser International support clients to establish, expand and divest their international businesses through strategic, value-added consulting and legal services, combining specialist know-how, connections, local partners and execution expertise.

Helal & Fraser’s focus is on ventures which combine advanced technology and know-how with opportunities in the Egypt, North Africa and Mediterranean region including new business establishments, joint ventures, acquisitions and divestments.